Cash App and Venmo are two of the most popular peer-to-peer (P2P) payment apps in the United States. Both apps allow users to send and receive money quickly and easily, and they offer a variety of features that make them convenient for everyday use.

Cash App vs Venmo, which one is right for you? In this today’s post, we’ll delve into the world of Cash App and Venmo, exploring their key features, security measures, transaction processes, and overall user experiences. By the end, you’ll have a clearer understanding of which one is the best for you.

So, if you’re ready to know more about Cash App and Venmo, let’s dive in and discover what sets them apart in this ever-evolving world of digital payments.

What Is Cash App?

Cash App is a mobile payment service that allows individuals to send and receive money using their smartphones. It was developed by Square. Cash App provides a convenient and user friendly platform for peer-to-peer money transfers, enabling users to send money to friends, family, or other individuals who also have the app installed on their devices.

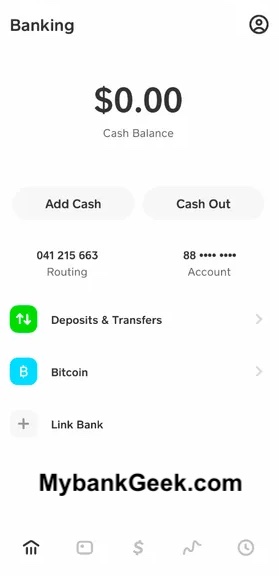

With Cash App, users can link their bank accounts or debit cards to the app and easily transfer funds. It also offers a unique username, known as a “$Cashtag,” which allows users to receive payments directly to their Cash App accounts using their unique identifier.

Cash App offers a variety of features, including:

- Send and receive money instantly: Cash App users can send and receive money to each other for free, with no fees.

- Buy and sell Bitcoin: Cash App allows users to buy and sell Bitcoin with ease.

- Invest in stocks: Cash App offers a simple way to invest in stocks, with no minimum investment required.

- Get a Cash Card: Cash App users can order a Cash Card, which is a Visa debit card that can be used to make purchases in stores and online.

How to get started with Cash App

- Download the Cash App App and use your phone number or email address to set up your account. This user friendly app allows you to select a $cashtag, a unique identifier that you can easily share with your family and friends for seamless money transfers.

- Link your card or bank account to Cash App. This will allow you to send and receive money from your bank account.

- To send money, you only need to provide the recipient’s email address, phone number, or $cashtag. Once you’ve entered the necessary information, the app will prompt you to choose how you would like to withdraw the money. You can opt to use your Cash App balance, linked bank account, or credit card to make the payment.

- When you receive money, it will be deposited directly into your Cash App account. From there, you have the flexibility to withdraw the funds to your linked bank account or debit card. Alternatively, you can choose to maintain a balance within your Cash App account for future transactions.

Is Cash App Safe?

Cash App is safe to use. The app uses encryption and fraud detection technology to protect your data and money. Here are a few things you can do to keep your Cash App account safe:

- Enable two-factor authentication (2FA). This adds an extra layer of security by requiring you to enter a code from your phone in addition to your password when you log in.

- Be careful about who you send money to. Only send money to people you know and trust. If you’re not sure, it’s better to err on the side of caution and not send any money.

- Be aware of scams. There are many scams that target Cash App users. Be careful about clicking on links or responding to messages from people you don’t know.

- Never give out your Cash App PIN or sign-in code. Cash App will never ask for this information.

By following these tips, you can help keep your Cash App account safe.

What Are The Pros And Cons Of Cash App?

| Pros | Cons |

|---|---|

| Easy and convenient to use | Limited availability outside the United States |

| Instant peer-to-peer transfers | Fees for certain transactions and expedited transfers |

| Free to send money | Limited amount to send in a day, week and monthly. |

| Cash Card for spending | Limited integration with other financial services |

| Cash Boosts for discounts | Fees for instant deposits and sending money with a credit card |

| Available on iOS and Android | Not a bank |

| Offers a debit card | Limited features for business use |

| Bitcoin trading feature | No interest or investment options for stored funds |

| Mobile check deposit feature | Limited acceptance by merchants compared to traditional cards |

| Option to invest in stocks | Possible account holds and suspensions without clear reasons |

| Cash App debit card for ATM | Limited options for dispute resolution |

| Secure | Possibility of account suspension |

What Is Venmo?

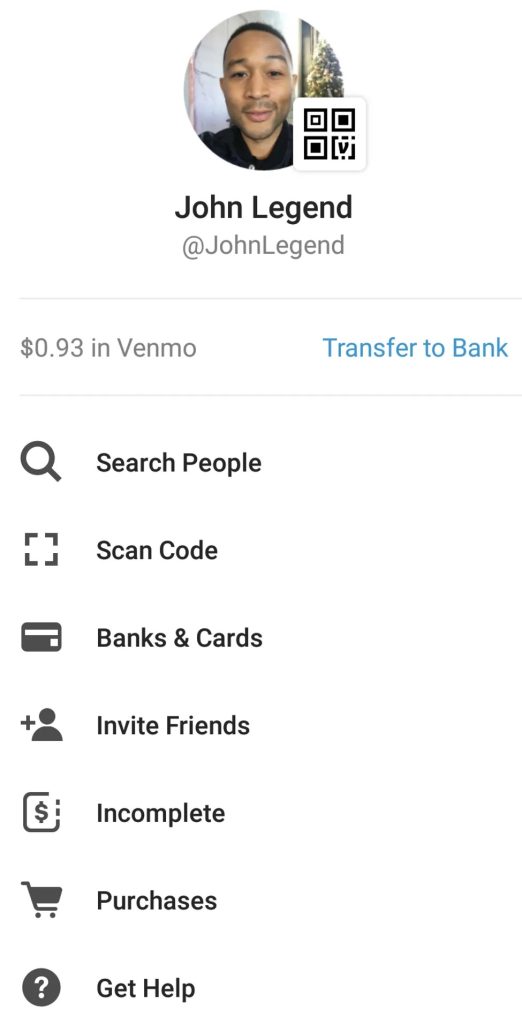

Venmo is a popular mobile payment service that allows users to send and receive money electronically. It was created to simplify the process of splitting bills and making payments among friends, family, and acquaintances. Venmo operates through a mobile app, available for both iOS and Android devices, and it’s owned by PayPal.

Venmo is a safe and convenient way to send and receive money. All Venmo transactions are encrypted and protected. Venmo also offers fraud protection and buyer protection.

Here are some of the benefits of using Venmo:

- It is a quick and easy way to send and receive money.

- It is a secure way to send and receive money.

- It is a convenient way to split bills and pay for shared expenses.

- It is a fun and social way to send money to friends and family.

How to get started with Venmo

To get started with Venmo, you will need to:

- Download the Venmo app from the App Store or Google Play.

- Open the app and create an account. You will need to provide your name, email address, phone number, and a password.

- Verify your phone number and email address.

- Link a bank account or credit card to your Venmo account.

Once your account is set up, you can start sending and receiving money. To send money, simply enter the recipient’s username or phone number. To request money, simply enter the amount you need and the reason for the request.

Venmo transactions are typically processed within minutes. There are no fees for sending or receiving money from other Venmo users who have linked a bank account. However, there is a 3% fee for sending or receiving money from other Venmo users who have linked a credit card.

Is Venmo Safe?

Venmo is a safe way to send and receive money. . It uses encryption and other security measures to protect your account information and transactions.

What Are The Pros And Cons Of Venmo?

| Pros | Cons |

|---|---|

| Convenient and easy to use | Security risks |

| Instant transfers and real time notifications | Limited customer support and responsiveness |

| Splitting bills and requesting payments is simple | Potential for fraudulent activity |

| Supports both iOS and Android devices | Transaction fees for certain transactions |

| Fee-free | Lack of buyer/seller protection for goods and services |

| Integration with popular apps and online services | Not a good option for business payments |

| Option to link a bank account, debit card, or credit card | Not available in all countries |

| Wide acceptance and popularity among users | Restricted use for certain business |

| Offers rewards and cashback programs | Limited customization options |

| Automatic synchronization with transaction history | Some users report issues with account verification |

Cash App vs Venmo

| Feature | Cash App | Venmo |

|---|---|---|

| Owner | Square, Inc. | PayPal Holdings, Inc. |

| Payment Types | Peer-to-peer transfers | Peer-to-peer transfers |

| Sending/Receiving | Instant | Instant |

| Mobile App | Available on iOS and Android | Available on iOS and Android |

| Transfer Speed | Instant transfers | Instant transfers |

| Debit Card | Cash Card available | Venmo card available |

| Bitcoin Support | Yes, allows buying/selling Bitcoin | No direct support for Bitcoin |

| Fees | 0% for sending payments from Cash App balance or linked bank account. 0.5%-1.75% fee for instant transfers 3% for sending money using a credit card | 0% for receiving or sending money from debit card, balance, prepaid card or linked bank account 1%-5% — $5 minimum — for faster access to cashed checks 3% for sending funds using a credit card |

| Transfer Speed | 1-3 business days for standard transfer and instant transfer are processed immediately. | 1-3 business days for standard transfer and instant transfer are processed immediately. |

| Cash Out Options | Instant transfers to linked bank accounts | Instant transfers to linked bank accounts |

| Payment Limits | $2,500 per week for unverified users, $7,500 per week for verified users | $299.99 per week for unverified users, $60,000 per week for verified users |

| Customer Support | Available 24/7 via phone, chat, and email | Available 24/7 via phone, chat, and email |

Which One is Right for You?

If you are looking for a payment app with a wide range of features and a lower fee structure, then Cash App is a good choice. If you are looking for an app that is more widely accepted and has a simpler user interface, then Venmo is a good choice.

Both Cash App and Venmo are free to download and use, so there is no risk in trying them out.

Cash App vs Venmo: Which Is Better?

Cash App and Venmo are both popular mobile payment apps. They allow users to send and receive money quickly and easily, and they both offer a variety of features. However, Cash App offers a wider range of features than Venmo. In addition to sending and receiving money, Cash App also allows users to invest in stocks, buy bitcoin, and receive direct deposits.

Also, Cash App has lower fees than Venmo for some transactions. For example, Cash App charges a flat fee of $2.50 for ATM withdrawals, while Venmo charges a percentage of the withdrawal amount. With this, Cash app is considered better.

Is Venmo Safer Than Cash App?

Both Venmo and Cash App are safe.

However, there are some of their security features.

- Venmo: Venmo uses bank-level encryption to protect your money and data. It also offers two-factor authentication, which requires you to enter a code from your phone in addition to your password when you log in.

- Cash App: Cash App also uses bank-level encryption to protect your money and data. It also offers two-factor authentication.

In addition to these security features, both Venmo and Cash App offer fraud protection and they are safe to use.

Conclusion

This article has shown you everything you need to know about Cash App and Venmo. both Cash App and Venmo offer convenient and user friendly mobile payment solution.

I hope this blog post has been helpful. If you have any further questions, please feel free to drop a comment.

FAQS

How do Cash App and Venmo differ?

Cash App and Venmo have similarities, but there are some key differences between the two platforms. Cash App offers additional features like the Cash Card and the ability to buy and sell Bitcoin, while Venmo doesn’t. Additionally, Cash App allows users to create unique $Cashtag usernames, whereas Venmo uses standard usernames.

What are the limits for using Cash App and Venmo?

Cash App and Venmo both have limits on the amount of money you can send and receive each day. These limits depends if your account is verified or not.

Is Cash App or Venmo more popular?

Venmo is more popular than Cash App. According to Statista, Venmo had 79 million active users in 2022, while Cash App had 73 million active users.

Are Cash App and Venmo secure?

Cash App and Venmo are both secure payment apps. Both apps use a variety of security measures to protect your money and personal information, including:

Data encryption: All data transmitted between your device and the app is encrypted, which helps to protect it from unauthorized access.

Two-factor authentication: You can enable two-factor authentication to add an extra layer of security to your account. This will require you to enter a code from your phone in addition to your password when you log in.

Fraud protection: Both Cash App and Venmo offer fraud protection programs that can help you recover money if you are the victim of fraud.

Suzan was born in 1969 in Los Angeles and grew up in the San Fernando Valley. She attended UCLA, graduating in 1992 with a BA in Social Welfare.

From 1999 to 2004, Weiss was a visiting professor at Johns Hopkins’ Krieger School of Arts and Social Sciences and an adjunct professor of creative writing at The New School’s Eugene Lang College. She has also taught at the School of the Art Institute of Chicago, New York University, and Columbia University.

She currently lives in Los Angeles with her husband and two sons.